Top Tip Tuesday - Is using buy now pay later a good move?

If thinking about applying for a home loan, try to avoid any buy now pay later products such as Laybuy, Afterpay, Zip, Humm or Pay day loan type products. While these may appear to be a good idea to

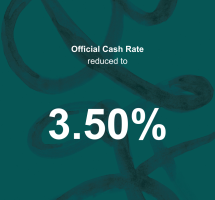

Home Loan Affordability

Over the past few months we have seen a lot of media coverage regarding the difficulties of obtaining lending to buy a home. Credit criteria to be met is tougher following the introduction of the

Approaches to Arranging Personal Insurance

When they are considering personal insurance we generally find from our previous experience that clients come to us with one of three different proposals. The first is based on what we, as