Home Loan Affordability

19 April 2022

Over the past few months we have seen a lot of media coverage regarding the difficulties of obtaining lending to buy a home. Credit criteria to be met is tougher following the introduction of the Credit Contract and Consumer Finance Act (CCCFA) and each lender has a different set of values and estimated living expenses that they will apply to their affordability calculator to determine whether you have the available funds to make the lenders repayments.

So, what do you need to pass on affordability? The first important piece of information is income.

As well as wages or salaried income, any Family Tax Credit payments, rental and boarder income received can be used as valid income. Overtime may only be included if it’s regular and it’s best to take an average of the high and low months rather than just working on extremes. For self-employed borrowers, lenders will require complete financial reports and will base income as anything earned, less expenses.

Now onto the expenses!

Firstly, those payments that need to be made on a regular arranged basis such as Hire Purchases, Personal Loans and although a surprising amount of people forget that they have them as a debt, car and student loans. These are the payments for those things that we have to have now and as they are usually set up over a relatively short term (Often with higher interest rates), the repayments can eat into your available funds quite significantly.

Then, there are Credit Cards and Store Cards. While you may only have them “for emergences” and may only pay the minimum required each month, as far as UMI calculators are concerned, 3% of the limit on your card/account is used as the monthly repayment figure. Therefore, if you have a $10,000 limit on your credit card, the lender will assume an extra cost of up to $400 per month. You may argue that the most you’ve ever spent on it was $1,500 but in theory, you have the potential to go on a mad retail spending spree and rack up that debt to its full limit.

It should also be remembered that Revolving and Line of Credit facilities also fall into this category, as even though you may be going great guns on reducing your debt, it is the limit rather than the balance that is taken into consideration on the UMI calculator. For a similar reason, After Pay or Laybuy loans should be avoided if possible, as lenders will factor these as an ongoing cost.

Other expenditure amounts are your normal monthly living expenses, such as groceries, rates, insurances, petrol, power, phone, as well as takeaways, nights out, child care, trips to the dentist/hairdresser/doctor, which all need to be taken into consideration.

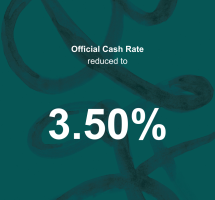

The key advice is that in these tighter times with interest rates climbing, the better the surplus of funds, the more likely you are to having your lending request approved.