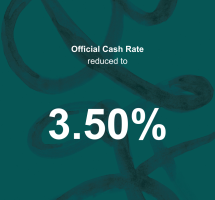

OCR has dropped to 3.50 %

New Zealand's OCR has dropped to 3.50 %! Official Cash Rate (OCR) drops typically lead to lower interest rates, which can have positive implications for various financial

O'Hagan Home Loans and Insurances Merge with Apex Advice to Enhance Services

O’Hagan Home Loans & Insurances, a trusted name in Whakatane for over 30 years, is excited to announce a strategic merger with Apex Advice. This collaboration will empower O’Hagans

OCR announcement - what does this mean for you?

Earlier today the Reserve Bank announced they have cut the OCR by 0.25%, lowering it to 5.25% - the first cut in 4.5 years. With inflation now sitting within the target band of 1 – 3% the

Goal Setting in 2024

As we say goodbye to 2023 and look forward to 2024 the start of a new year allows us to stop and contemplate what we hope to achieve in the upcoming year. This includes financial goals. The

First Home Buyer - how to get into the market?

Many people today are commenting that they will never own their own home. This is far from the truth. There are many ways to enter the property market and for people to buy their

Why should I get insurance?

Insurance is a form of “risk transference” e.g you are not in a financial position to address the risk yourself so you transfer that risk to a 3rd party such as an insurance agency.

Top Tip Tuesday - Expenses

Align your expenses with your pay schedule. For example, if you get paid weekly then make as many of your payments on your commitments weekly so that those are paid first and you don't have to

CCCFA - What does this mean for me?

Great news! In the recent weeks the Government have reviewed the interpretation of the CCCFA which was introduced 01/12/2021. Initially this casued banks to go on a major credit crunch resulting in